WE PROVIDE FREE TAX ASSISTANCE.

Tax Preparation Service Options

United Way connects people to free tax preparation offerings and helps filers get the tax credits for which they are eligible.

United Way connects people to free tax preparation offerings and helps filers get the tax credits for which they are eligible.

File Online for Free at MyFreeTaxes

MyFreeTaxes helps people file their federal and state taxes for free, and it’s brought to you by United Way.

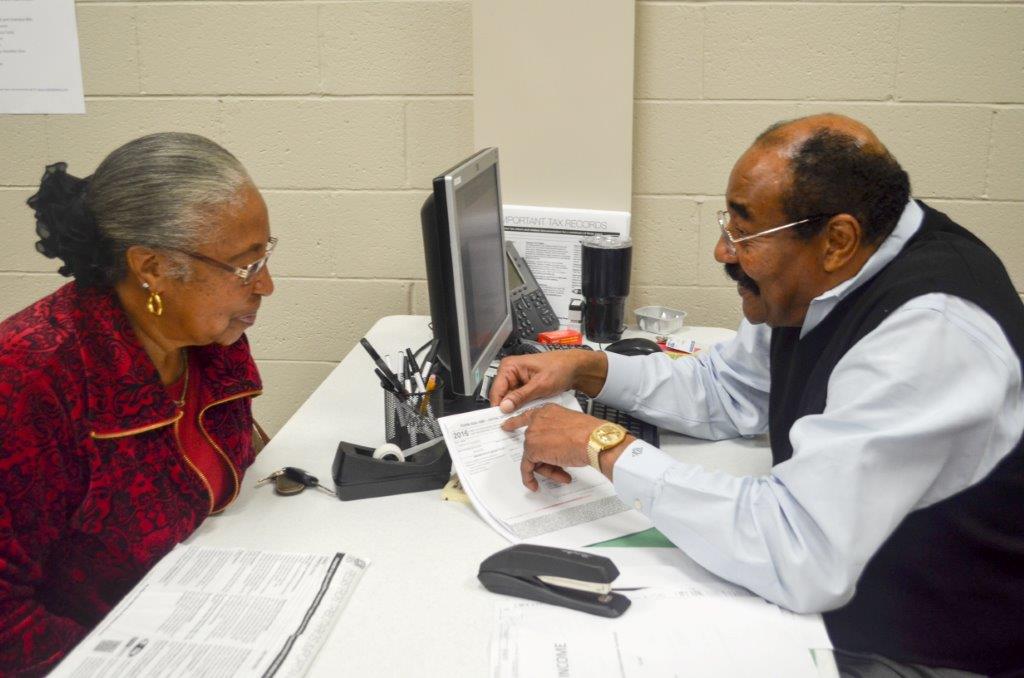

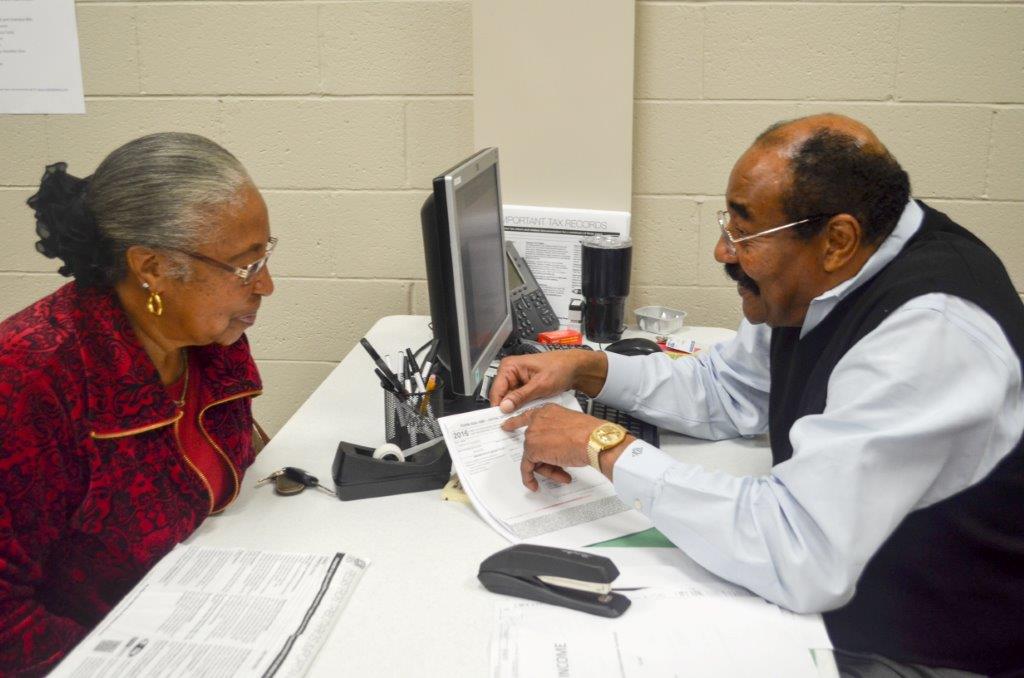

Tax Preparation by United Way Volunteers

United Way of Central Alabama offers free volunteer tax preparation for households with annual income of $54,000 or less.

About Free Tax Services

Prepare Your Own Return with MyFreeTaxes

MyFreeTaxes helps people file their federal and state taxes for free, and it’s brought to you by United Way.

There are no income limits for this service. Telephone support is available for prompt answers to any questions you may have.

Tax Preparation by United Way Volunteers

United Way of Central Alabama offers free volunteer tax preparation for households with annual income of $54,000 or less.

For an appointment, or to request accommodations, please call 2-1-1 or 1-888-421-1266.

See the list below for documents to bring to your appointment for intake. Your tax return will be prepared and ready for your signature in approximately one week.

What Information Do Tax Filers Need to Gather to be Ready for Tax Preparation?

United Way’s Free Tax Preparation program advises tax filers to bring (or submit online) the following documents for their tax preparation appointment:

- Social Security cards for all family members

- Driver license or non-drivers ID (spouses filing jointly must both be present)

- Last year’s federal and state tax returns

- W-2 forms

- 1099s for interest, dividends, retirement, Social Security, unemployment or self-employment

- 1095 for health insurance coverage

- Letters or documents from the IRS

- Childcare receipts – name, address, tax ID# and amount paid

- Tuition expenses and book receipts (1098T) and student-loan interest (1098E)

- Receipts for property tax, vehicle tags, charitable gifts and medical, dental and prescription-drug expenses

- Voided check or direct deposit

About the Volunteer Income Tax Assistance (VITA) Program

Volunteers are the key to “free” in United Way’s Free Tax Preparation program. We offer a variety of year-round volunteer opportunities. We welcome volunteers from all backgrounds. You DO NOT need to have professional experience in accounting or finance to help. If you are willing and able to learn, and want to provide valuable assistance to your community, this could be a great opportunity for you!

Questions? Email us at taxvol@uwca.org.

Preparers

Complete our tax-preparation training classes (approximately 8 hours) to become an IRS-certified tax preparer. Once certified, you can volunteer to complete tax returns for members of our community.

Greeters

Complete an open-book test (less than 1 hour) to become an IRS-certified volunteer. You’ll welcome clients, explain how the Free Tax Preparation program works and ensure that they have all the necessary documents to get their taxes prepared.

Student Interns

Strengthen your resume and demonstrate to employers your skills at applying tax law, using tax software and working with customers to complete accurate tax returns.

UWCA Spotlight

Tax Prep Volunteers Make a Difference

Judy Allen, Director of Volunteer Income Tax Assistance (VITA), and Doug Horst, Director of Financial Stability Services, discuss why helping people with their taxes matters and how Central Alabama residents can make a difference by becoming Tax Prep volunteers.

Read Their StoryFAQ for Tax Prep Volunteers

Why Volunteer?

Taxpayers who use our program save an estimated $250 in preparation fees per return. This is money that they can use for a car repair, to catch up an unexpected bill, or to stock their pantry with groceries. Thousands of individuals and families turn to United Way of Central Alabama each year seeking help filing their taxes.

What Health and Safety Precautions are in Place?

United Way prioritizes safety of both volunteers and clients. Volunteers may opt to assist clients in person or serve behind the scenes. If serving clients in person, they will be separated by a plexiglass shield and other dividers to allow conversation and sharing of documents while maintaining a safe distance. Masks are available for use by volunteers and customers if desired.

How Do I Register for Tax Prep Volunteer Training?

Follow the link posted above on this page to express interest in volunteering and to register for training.

What is Covered in the Training?

Volunteers will receive reference material and learn to apply frequently used tax law, as well as learn to prepare returns using tax software. They will set up a password to training software that they can access after class for further practice if desired. In addition, they will have access to videos to watch for further review and reference materials to keep and review.

Do I have to Complete a Certification to Volunteer?

Volunteers need to complete an open-book IRS certification before volunteering. The training classes offered cover all material needed for the certification; at the end of class, volunteers will be ready to complete their tests. Additional one-on-one help is available for remaining questions about the certification process, if needed.

Once certified, email your Volunteer Agreement to taxvol@uwca.org, and you will receive instructions on signing up for your shift.

What if I Do Not Pass My Certification Test?

The passing score for each Certification is 80 or higher. Volunteers who did not pass on the first try may take a retake test, but only once. Contact United Way before beginning the retake to make sure that you understand the correct answers to the questions you missed.

Where Do I Volunteer?

Tax volunteers will work onsite at United Way of Central Alabama, in the Spain Community Chest Building, the same location where orientation and training sessions are located.

Where is United Way of Central Alabama?

3600 8th Avenue South in the Avondale/Forest Park neighborhood.

From St. Vincent’s Hospital, follow University Boulevard east about eight blocks. The street name will change to Clairmont Avenue. Watch for the Piggly Wiggly on the left at 34th Street South. After the Piggly Wiggly, go one more block past Park 35 Apartments, and turn left at 36th Street South. The entrance to UWCA’s parking lot is one block ahead at the top of the hill. Once in the parking lot, follow the drive a little further up hill, and the Spain Community Chest Building will be on your left at top of the hill and has a sign over the entrance. Check in with the receptionist to sign in and get your volunteer badge and name tag.

What Do I Do as a Volunteer?

Most appointments for clients allow them to complete a drop-off interview one week, then return the next week to sign and pick up the completed return. Volunteers can help with the drop-off and pick-up meetings.

Volunteers also have the option to prepare returns that have already been dropped off, or that were received online. Many new volunteers like to do this as a way to get familiar with the process before assisting clients in person.

Greeter Volunteers assist arriving customers who may need help completing their intake paperwork and escort customers back to meet with the volunteer who will complete their interview.

What if I have Questions While Volunteering?

United Way Site Coordinators are always on hand to respond to your questions. In addition, tabbed reference guides are available at each workstation to assist you with your questions.

What if I Make a Mistake?

In training, we teach that every return must go through a second check, called a Quality Review, before it is signed by the client. Ask questions as you have them, and if there are any issues that you think need close attention, attach a note to the return for the reviewer. This process allows an opportunity for mistakes to be identified and corrected prior to meeting with the client.

What is My Liability as a Volunteer?

The Volunteer Protection Act generally protects unpaid volunteers from liability for acts or omissions that occur while acting within the scope of their responsibilities at the time of the act or omission. It provides no protection for harm caused by willful or criminal misconduct, gross negligence, reckless misconduct or conscious, flagrant indifference to the rights or safety of the individual harmed by the volunteer.

What’s the Schedule?

Monday through Friday 8 a.m. to 4:30 p.m.

RELATED RESOURCES

Financial Stability

We help put individuals and families on the road to financial stability. An investment in long-term human success leads to long-term economic success.

Financial and Housing Education

Providing prospective homeowners and renters the information and support they need to achieve and sustain their housing goals.