Are you pretty good with numbers? Do you enjoy helping a people in need?

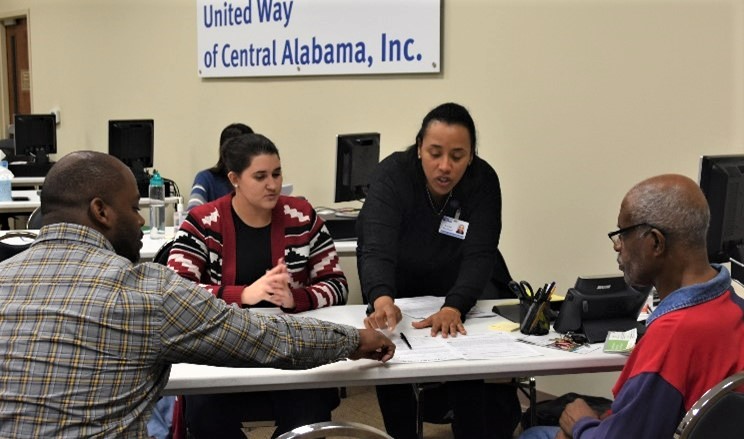

If you answered yes, you should consider becoming a United Way Tax Volunteer. The Free Tax Preparation Program of United Way of Central Alabama assists thousands of area residents with household incomes of $54,000 or less every year. Our services help them save an average of $200 in fees. And volunteers are the lifeblood of the program.

You DO NOT need to have professional experience in accounting or finance to help (although retired and active professionals are strongly encouraged to step up). You simply need to be willing and able to learn with a desire to make a positive difference in the lives of others. AND WE NEED YOU NOW.

We have opportunities for those who want to actually prepare tax returns, as well as for friendly people who will greet clients, explain the program and check clients’ documents in order to have their taxes prepared. We even welcome student interns who want to get real-world experience while also giving back to their community.

The best part is we provide all the training. Classes are held in November and December and include:

- Virtual and in-person class options.

- Videos, reference material and training software for use in between classes.

- Additional one-on-one help if needed.

- Open-book IRS-Certification test upon completion of your classes.

With your training and certification complete, you’ll set your schedule during tax season and work at the United Way office in Birmingham’s Forest Park neighborhood. Then be prepared for the special reward that comes from helping others. It gives a whole new meaning to the term “tax return.”

Sign up now to join us for November or December training. Or email taxvol@uwca.org with questions.